Publish Date: February 1st, 2018

The final draft of the new tax bill delivered some unexpected benefits to the solar industry and to commercial entities interested in going solar. The tax bill changes the risk and rewards calculations involved in commercial solar energy and moves the needle further into the reward territory. The two provisions at play are the reduced corporate tax rate and the changes to depreciation allowances that greatly increase the potential value of solar PV projects. These tax changes are great news for anyone who has been on the fence about investing in a commercial solar project and will make many more projects financially feasible.

Reduced Corporate Tax Rate

The first provision in the new tax bill that makes solar PV more profitable is the reduced corporate tax rate. When commercial entities add solar PV systems, the immediate impact is a reduced utility bill. Less money going out to cover operating expenses means more profits, and these profits are a tax liability. Under the new tax plan, the federal corporate tax rate has been reduced from 35 percent to 21 percent. This reduced tax rate now makes your solar profits more profitable.

Bonus Depreciation

The second provision in the new tax bill that will give commercial solar a boost are the revised depreciation allowances. Depreciation is a deduction that allows corporations to reduce their taxable profits by claiming wear and tear of certain assets, like solar PV systems. In the past, tax law allowed corporations a 50% bonus depreciation of a new asset’s value during the first year and the remaining value over five and a half years. Under the new tax bill, 100% of an asset’s value can be deducted as depreciation in the first year.

As depreciation is calculated as an expense, it lowers the company’s net profit that must be reported and taxed. The tax bill will allow the full cost of equipment to be written off immediately rather than depreciated over time. Most companies like the idea of lowering their tax liability as quickly as they can as this means keeping more of the money that was earned.

More Solar Rewards

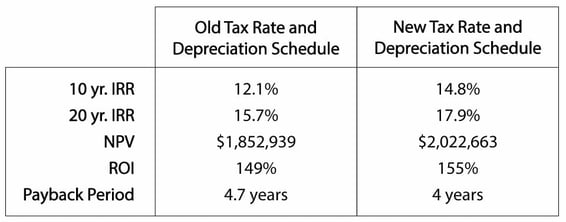

The effects of these two provisions will dramatically change the cost and benefit analysis of these projects. Commercial solar PV projects will see higher return on investments (ROI), increase net present values (NPV), and shorter payback periods.

To see the effects the tax bill will have on ROI and NPV, take a look at Greentech Media’s analysis. They look at a 366-kilowatt commercial solar project in California and estimate the economic benefits of reducing tax rates and doubling the bonus depreciation. In this specific example, they see ROI increase by 6.7% and NPV increase by 27%.

Here’s another sample project. Below is the financial analysis for a 1,342.32 kW (DC) solar PV project for a manufacturing facility. This is a ballasted roof-mounted array priced at $2,769,000 or $2.06/w. All financial indicators show an attractive bump as a result of the reduced corporate tax rate and the higher bonus depreciation.

If you’re a business owner considering solar, these examples show the dramatic impact of the new tax bill on commercial solar PV projects and how your investment in solar energy will pay for itself in a shorter amount of time. Take advantage of these unexpected benefits of the new tax bill and find out how much your business could earn with clean solar energy.

Get expert advice when you talk with one of our commercial and utility solar experts. Contact us for a free consultation for your project.